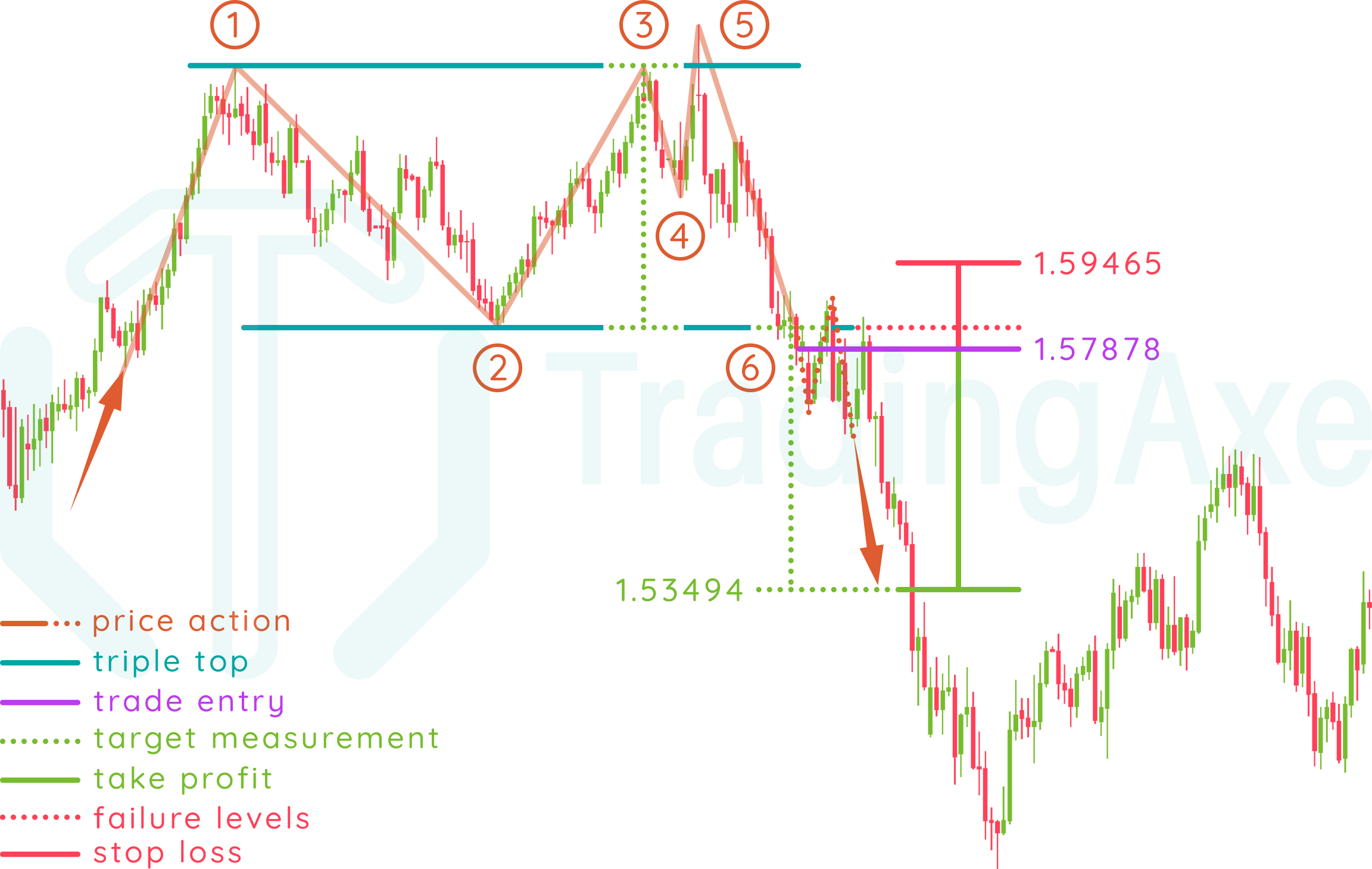

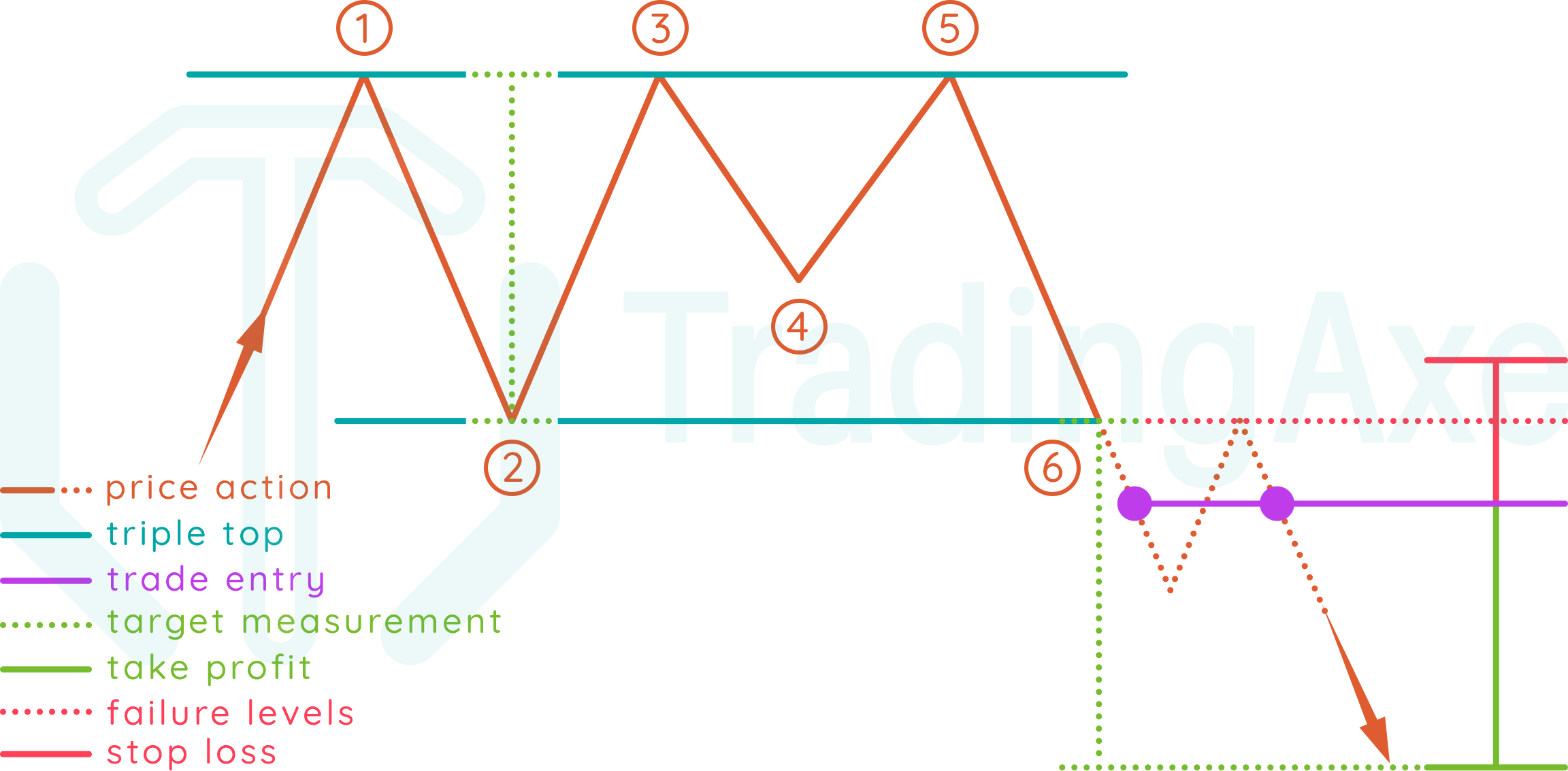

Entry: after breaking the pattern's lower border at point (6), either with an entry after the breakout, or after a possible retest of the lower border.

Take profit: identified by measuring the vertical distance between the pattern's upper and lower borders, that measurement is then applied from the breakout rate (6)

Stop loss: the pattern's lower border, which is identified by the point with the lower rate out of points (2) and (4)

TRIPLE TOP PRICE ACTION

This chart pattern starts forming with bulls already in control of the exchange rate's uptrend. Bears make a stand at a certain rate that will be tested exactly three times, before they are finally able to reverse direction, and the exchange rate starts a downtrend.

Let's break down the pattern formation!

In an uptrend, price action finds the first resistance (1), which will be the horizontal resistance for the rest of the pattern formation.

Price action reverses direction from the first resistance (1) and goes downwards till it finds the first support (2)

Price action reverses direction from the first support (2) and goes upwards, till it finds the second resistance (3), which will be around the same rate of the first resistance (1)

Price action reverses direction from the second resistance (3) and goes downwards, till it finds the second support (4), which can be higher or lower than the first support (2)

Price action reverses direction from the second support (4) and goes upwards, till it finds the third resistance (5), which will be around the same rate of the first resistance (1) and the second resistance (3)

The pattern is completed when price action reverses direction from the third resistance (5) and goes downwards till it breaks the pattern's lower border at point (6)

NOTES ON TRIPLE TOP

Direction

Reversal

Type

Bearish

Occurrence

Medium

Common term

All

Pip distance of the trend prior to the pattern formation should be noticeably longer than the pattern formation itself.

After the breakout, retesting the pattern's lower border, which was a resistance that turned to support, is highly possible.

Volume is usually high when reversing from the second (3) and third (5) resistances, as well as when breaking the pattern's lower border.

This pattern is commonly found on all time frames.

TRIPLE TOP REWARD:RISK

R:R depends on the (lower border-entry rate) distance, compared to (upper border-lower border) distance.

Always remember that the stop loss level explained above is absolute, the actual stop loss rate for your trade setup should be a bit beyond those levels to give the trade setup some room to breathe, and of course, calculations for position size and R:R should be done with respect to that rate.