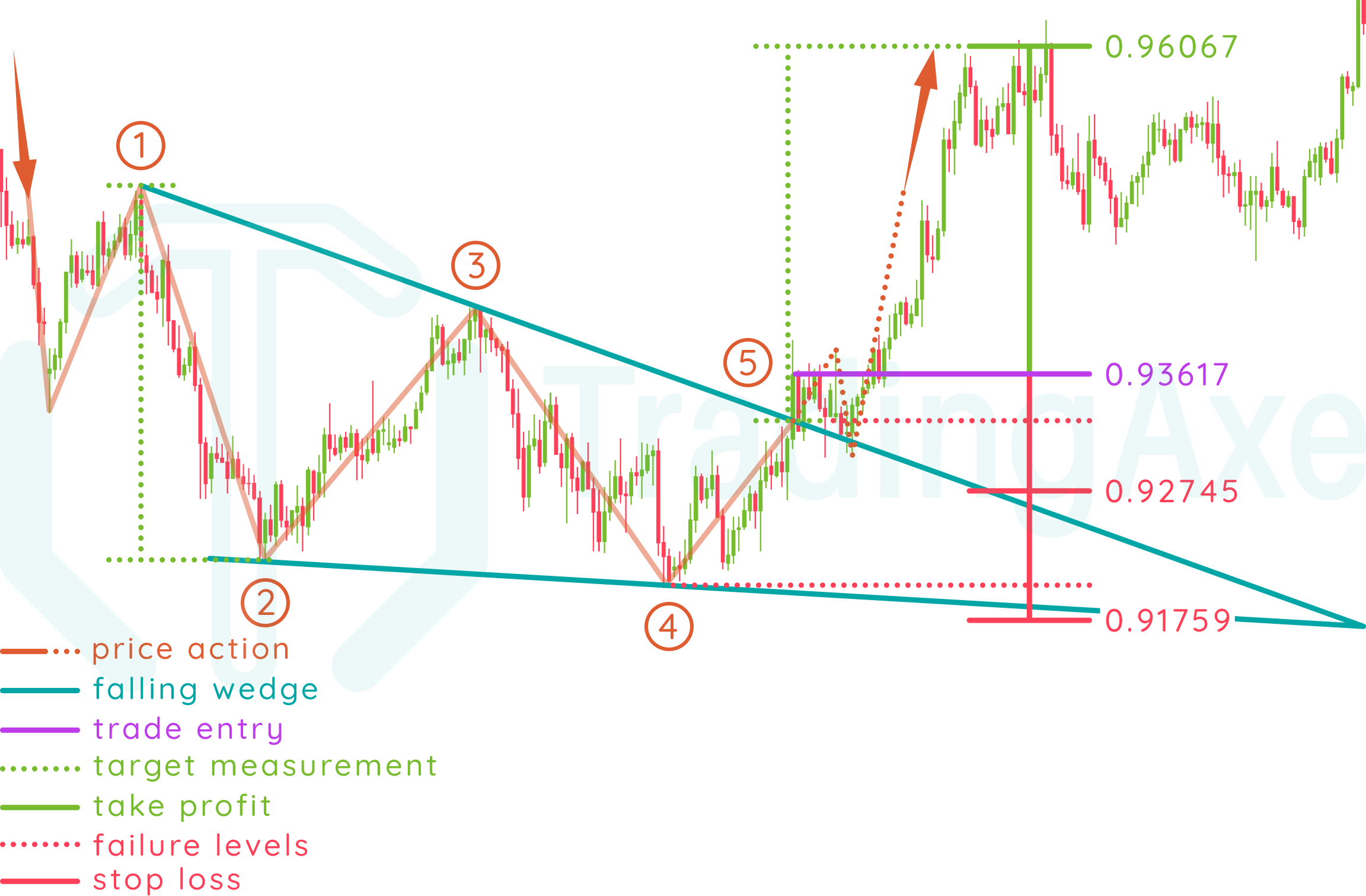

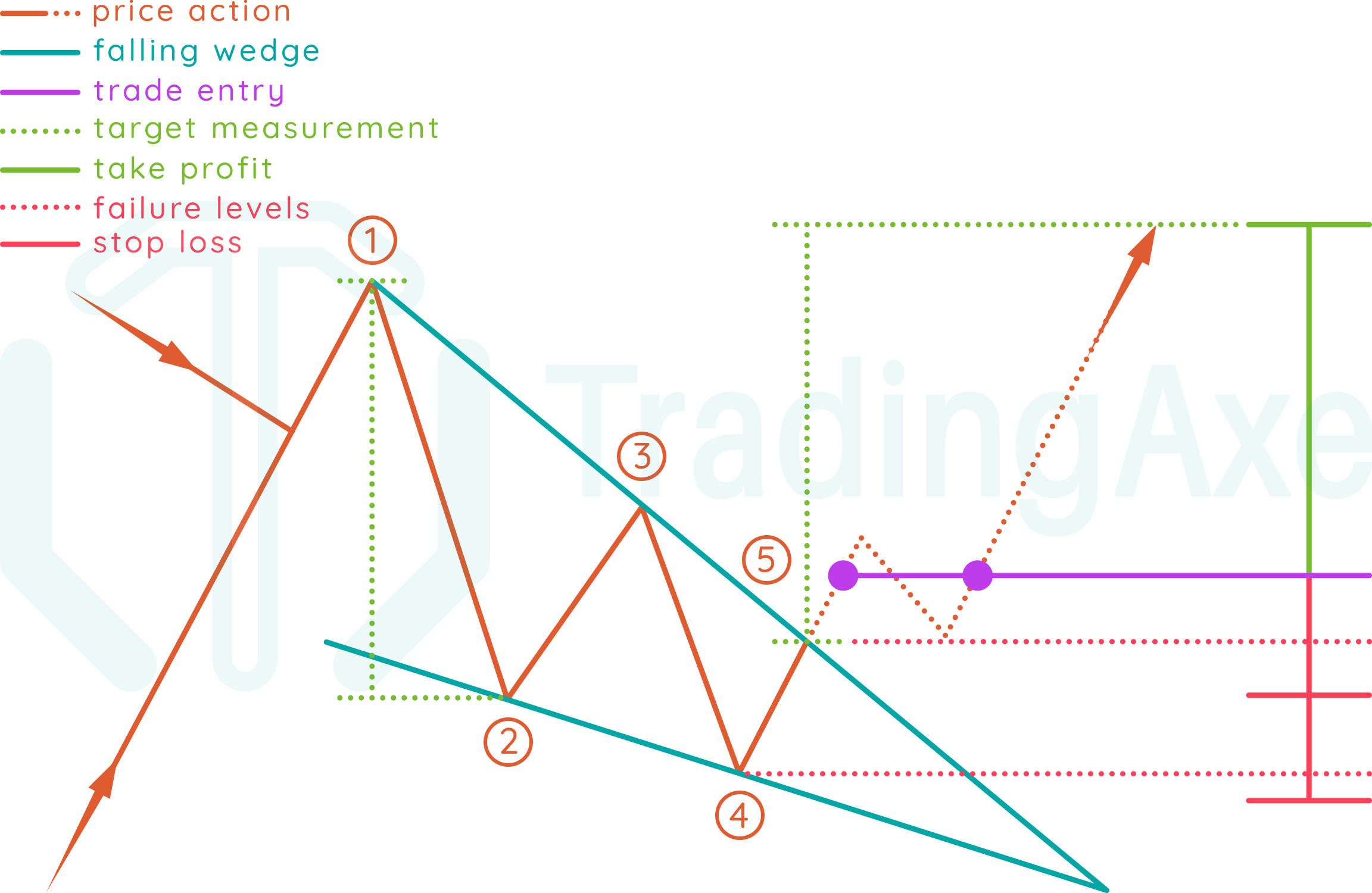

Entry: after breaking the wedge's upper border at point (5), either with an entry after the breakout, or after a possible retest of the upper border's breakout rate.

Take profit: identified by measuring the vertical distance between the first resistance (1) and the first support (2), that measurement is then applied from the breakout rate (5)

Stop loss: can either be the breakout rate (5), or the last touch to the wedge's lower border (4) before the breakout

FALLING WEDGE PRICE ACTION

This chart pattern can be formed after either an uptrend or a downtrend. Bears make the first move by creating a resistance and pushing the exchange rate downwards. As bulls try to fight back, it looks like the bears have the upper hand as lower highs and lower lows are being formed. However, bulls suddenly start an uptrend by breaking the wedge's upper border resistance that was created by the bears.

Let's break down the pattern formation!

Price action finds the first resistance (1), which will be the highest high in the pattern.

Price action reverses direction from the first resistance (1) and goes downwards till it finds the first support (2), which will be the highest low in the pattern.

Price action reverses direction from the first support (2) and goes upwards, till it finds the second resistance (3), which must be lower than the first resistance (1)

Price action reverses direction from the second resistance (3) and goes downwards, till it finds the second support (4), which must be lower than the first support (2)

The pattern is completed when price action reverses direction from the second support (4) and goes upwards till it breaks the wedge's upper border at point (5)

NOTES ON FALLING WEDGE

Direction

Neutral

Type

Bullish

Occurrence

Medium

Common term

All

Before the breakout, 4 touches to the wedge's upper and lower borders are the minimum for a valid pattern, more touches are acceptable.

For the pattern's shape to converge, the down-slope of the wedge's upper border (1-3-...) must be considerably sharper than that of the lower border (2-4-..). However, it is acceptable for a falling wedge pattern to form without both borders intersecting in the near future, the key point is that the wedge's upper border down-slope must be sharper than that of the wedge's lower border.

Since the price action inside the wedge formation is a downtrend, and since its target is a bullish one, the breakout volume should be considerably high to confirm that more bulls are entering the market.

This pattern is commonly found on all time frames.

FALLING WEDGE REWARD:RISK

The sharper the wedge's upper border down-slope than that of the lower border, the better the R:R.

R:R improves when the breakout is nearer to the wedge borders' intersection point.

Always remember that both stop loss levels explained above are absolute, the actual stop loss rate for your trade setup should be a bit beyond those levels to give the trade setup some room to breathe, and of course, calculations for position size and R:R should be done with respect to those rates.