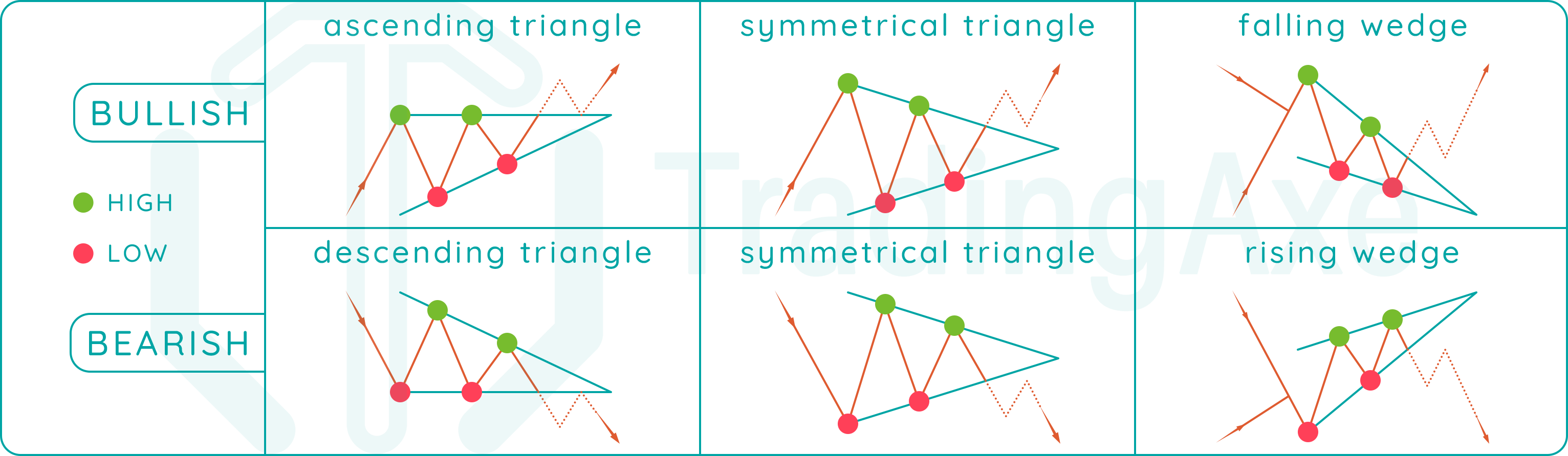

To differentiate triangle chart patterns, we will be using highs and lows as well as the trend prior to pattern formation.

ASCENDING TRIANGLE

Prior trend before pattern formation is bullish.

Highs inside the pattern formation are equal (around the same rate)

Lows inside the pattern formation are, ascending! This means that each new low formed should be higher than the previous low.

A minimum of two highs and two lows are required for a valid ascending triangle pattern.

DESCENDING TRIANGLE

Prior trend before pattern formation is bearish.

Highs inside the pattern formation are, you guessed it, descending! This means that each new high formed should be lower than the previous high.

Lows inside the pattern formation are equal (around the same rate)

A minimum of two highs and two lows are required for a valid descending triangle pattern.

BULLISH SYMMETRICAL TRIANGLE

Prior trend before pattern formation is bullish.

Highs inside the pattern formation are descending. This means that each new high formed should be lower than the previous high.

Lows inside the pattern formation are ascending. This means that each new low formed should be higher than the previous low.

A minimum of two highs and two lows are required for a valid bullish symmetrical triangle pattern.

BEARISH SYMMETRICAL TRIANGLE

Prior trend before pattern formation is bearish.

Highs inside the pattern formation are descending. This means that each new high formed should be lower than the previous high.

Lows inside the pattern formation are ascending. This means that each new low formed should be higher than the previous low.

A minimum of two highs and two lows are required for a valid bearish symmetrical triangle pattern.

FALLING WEDGE

Prior trend before pattern formation is neutral, can be either bullish or bearish.

Highs inside the pattern formation are descending. This means that each new high formed should be lower than the previous high.

Lows inside the pattern formation are descending. This means that each new low formed should be lower than the previous low.

A minimum of two highs and two lows are required for a valid falling wedge pattern.

RISING WEDGE

Prior trend before pattern formation is neutral, can be either bullish or bearish.

Highs inside the pattern formation are ascending. This means that each new high formed should be higher than the previous high.

Lows inside the pattern formation are ascending. This means that each new low formed should be higher than the previous low.

A minimum of two highs and two lows are required for a valid rising wedge pattern.

Let's summarize the unique characteristics for each triangle-shaped chart pattern we discussed in this lesson.

| ascending triangle | equal highs |

|---|---|

| higher lows | |

| prior trend: bullish | |

| descending triangle | lower highs |

| equal lows | |

| prior trend: bearish | |

| bullish symmetrical triangle | lower highs |

| higher lows | |

| prior trend: bullish | |

| bearish symmetrical triangle | lower highs |

| higher lows | |

| prior trend: bearish | |

| falling wedge | lower highs |

| lower lows | |

| prior trend: neutral | |

| rising wedge | higher highs |

| higher lows | |

| prior trend: neutral |